Stay disciplined and systematic in any macro sea.

LOGIC Macro Regime is a simple, quantitative and systematic framework for navigating financial markets based on the macro cycle. Back-tested across 14+ years of monthly data, size risk with confidence and avoid being tossed around by daily noise. One signal. Once a month. No hype – just a systematic view of the currents.

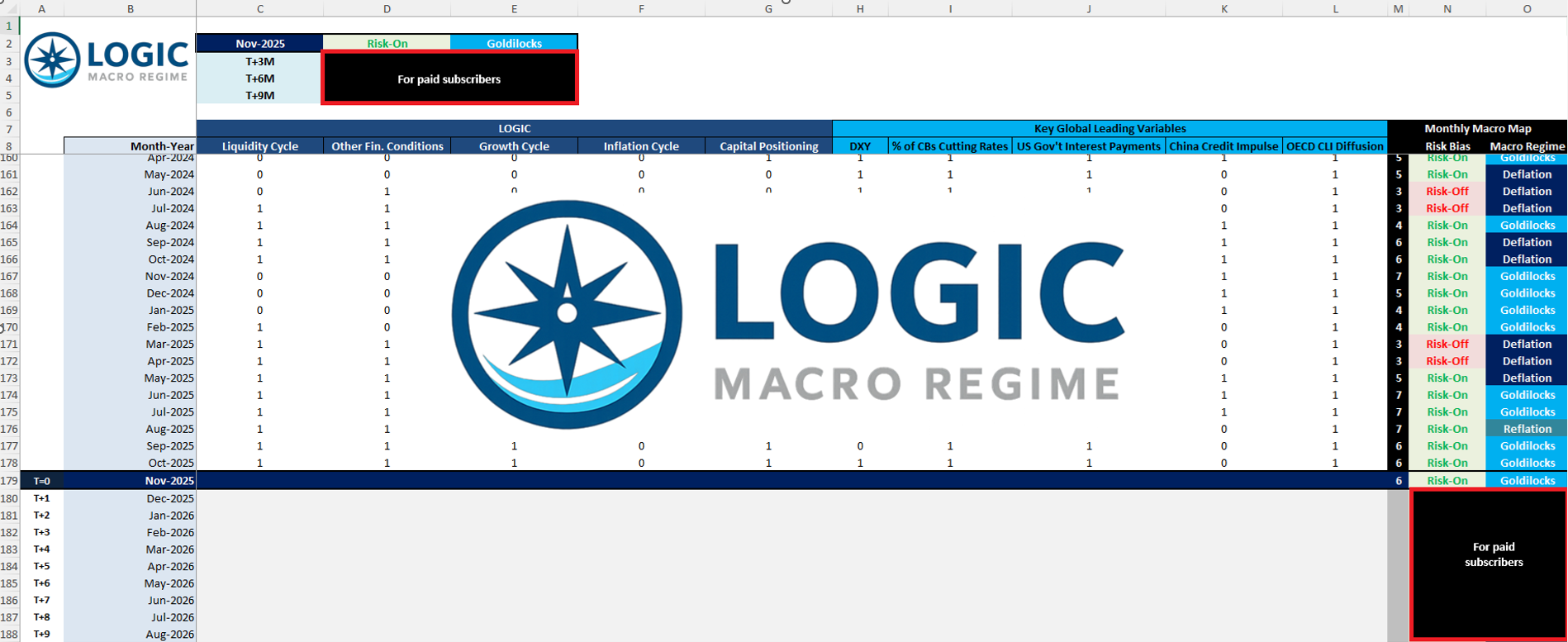

What the Monthly Macro Map looks like: a preview of the spreadsheet delivered before the month begins.

LOGIC Framework: your macro map

The frameworkShort explainer video: How LOGIC Macro Regime works

LOGIC Macro Regime distills nearly two decades of institutional macro and real-asset investment management experience into a simple, systematic framework for reading capital market signals.

Proprietary indicators anchored on the Liquidity Cycle, Other Financial Conditions and Capital Positioning are analyzed with key global leading variables – the US Dollar, US Government Interest Payments, the Proportion of Central Banks Cutting Rates, the OECD CLI Diffusion Index and the China Credit Impulse Index to identify if there are headwinds or tailwinds to the risk bias. The Growth Cycle and Inflation Cycle segment the Macro Regime – the sea conditions – and point towards style factors that are likely to out/under-perform.

The result is a Monthly Macro Map grounded in back-tested and empirical evidence of what truly drives markets – so you have a clear, data-driven map you can overlay on your own portfolio decisions. Its designed to keep savvy investors disciplined, objective and systematic as they navigate through macro waters. The models and seven switch indicators behind LOGIC are proprietary – you get the signal, not the wiring.

Macro Regimes: the four seas

REGIMES + RISK SCOREEach Macro Regime or sea is defined by the acceleration ↑ or deceleration ↓ of the Growth (G) and Inflation (I) cycles. Those simple directions segment the macro ocean into four distinct environments.

What tends to outperform / underperform in each regime?

Style factors & sectorsBelow is a list of how major equity style factors, sectors and fixed income categories have tended to behave in each LOGIC Macro Regime. Historical tendencies only – not a guarantee of future results and not investment advice.

- High Beta

- Small Caps

- Mega Cap Growth

- Cyclicals

- Mid Caps

- Low Beta

- Defensives

- Size

- Quality

- Dividends

- Consumer Discretionary

- Financials

- Technology

- Materials

- Industrials

- Utilities

- Communication Services

- Real Estate

- Consumer Staples

- Health Care

- Business Development Co. Loans

- Convertibles

- High Yield Credit

- Emerging Markets $ Debt

- Preferreds

- Long Duration Bonds 10yr+

- 0–5yr TIPS

- Mid Duration Bonds 2-10yr

- Mortgage Backed Securities

- 5–10yr TIPS

- Mega Cap Growth

- High Beta

- Cyclicals

- Momentum

- Small Caps

- Low Beta

- Dividends

- Defensives

- Quality

- Large Caps

- Technology

- Industrials

- Consumer Discretionary

- Financials

- Energy

- Real Estate

- Consumer Staples

- Utilities

- Communication Services

- Health Care

- Business Development Co. Loans

- Convertibles

- Preferreds

- High Yield Credit

- Emerging Markets Local Currency

- Long Duration Bonds 10yr+

- Mid Duration Bonds 2-10yr

- Investment Grade Credit

- Mortgage Backed Securities

- Short Rates

- Low Beta

- Mega Cap Growth

- Quality

- Dividends

- Defensives

- High Beta

- Small Caps

- Cyclicals

- Value

- Mid Caps

- Utilities

- Health Care

- Real Estate

- Consumer Staples

- Communication Services

- Energy

- Materials

- Financials

- Industrials

- Consumer Discretionary

- Long Duration Bonds 10yr+

- Emerging Markets $ Debt

- 5–10yr TIPS

- Mid Duration Bonds 2-10yr

- Investment Grade Credit

- Business Development Co. Loans

- Convertibles

- High Yield Credit

- Mortgage Backed Securities

- Leveraged Loans

- Dividends

- Low Beta

- Quality

- Defensives

- Growth

- High Beta

- Cyclicals

- Value

- Small Caps

- Mid Caps

- Real Estate

- Health Care

- Consumer Staples

- Utilities

- Consumer Discretionary

- Financials

- Industrials

- Technology

- Communication Services

- Energy

- Long Duration Bonds 10yr+

- Mid Duration Bonds 2-10yr

- Investment Grade Credit

- Mortgage Backed Securities

- Short Rates

- Preferreds

- Business Development Co. Loans

- Leveraged Loans

- High Yield Credit

- Emerging Markets Local Currency

One simple subscription. That’s it.

SubscribeLOGIC Macro Regime is intentionally minimal. One signal, once a month, focused on what actually matters for portfolio performance: where financial markets are in the macro cycle and where they’re likely heading over the next 6 months.

What paid subscribers receive each month

No courses, no short-term trade alerts. Just a clear Monthly Macro Map to help you prepare whether to drop anchor, batten down the hatches, or stay the course. Embark on your macro voyage today.

Contact Us

Questions & inquiriesQuestions about LOGIC Macro Regime or to receive a free sample of the Monthly Macro Map. Email: monthlymacromap@logicmacroregime.com